The Saudi Automotive service market is poised for growth with stake holders such as auto-garages, authorized dealers and third party service providers coming up with innovative solutions to meet the current challenge. There has been an healthy growth in online activities by the end customer be it in using apps for services, buying used cars or even to get best bargain price for parts.

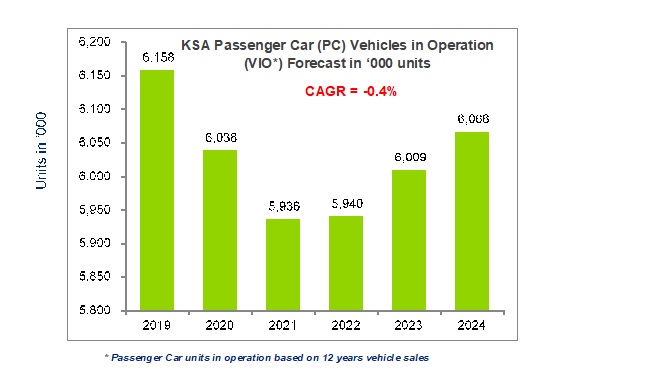

Historically, Saudi Arabia witnessed a decline in passenger car sales from 2016 to 2019 and the trend continued in 2020 due to Covid 19, this is likely to affect the aftermarket services market during 2021–2025 period as the stagnant vehicle parc.

Currently, the automotive industry is dominated by Japanese and Korean brands vying for market share in low end car section; however, European and American automakers have a significant share in the luxury cars segment.

Existing pressure on automakers profit margins has resulted in limited spare parts availability and aftermarket service innovations. Authorized service centers, third-party services and online service providers are moving towards a multichannel strategy to connect with customers. The companies are leveraging technologies such as data analytics, artificial intelligence (AI) and social media platforms to offer the right product/service at the right time to customers.

Automotive industry outlook

The KSA government has identified automotive industry as one of the core sectors to support the country’s sustainable manufacturing-based economy ahead of the oil & gas sector.

Market trends

The KSA automotive aftermarket services market, a prominent market in the Middle East, is likely to be driven by the country’s economic growth in accordance with infrastructure development, and growing logistics, e-commerce and tourism sectors:

• Localised Production by OEMs in the Middle East

• High Demand for Spare Parts

• Rising Investments in New Sales Channels

• Historic Surge in the Number of Female Drivers

• Boom in Second Hand Auto Spare Parts Market

• New emerging trends in mobile servicing, vehicle pick-up, delivery and online parts services to increase

• Growing used car market

Most vehicles and the parts sold in the country are imported. Auto parts market has a great potential in Saudi Arabia and the Saudi automotive market is now more geared towards a “service oriented” business model with more players focusing on customer experience and after sales service.

Unlike other countries where the dependence on public transport is high, the KSA market where dependence on personal cars is high for commuting the demand is not likely to be muted for long. The vehicles in operation (car parcand truck parc) remaining the same and also with the used car market expected to grow the aftermarket demand for auto components is expected to be stable.

According to a recent automotive research undertaken by Glasgow Consulting Group, about 83% of the vehicles in Saudi Arabia were without warranty and seek external aftermarket services. Furthermore, about 94% vehicle drivers consider third party aftermarket service, which implies that a significant number of customers are willing to avail the services of an outside workshop for car maintenance.

Almost 50% of the respondents claim that pattern of servicing is not fixed irrespective of travelling within city or outside city

- The prominent services includes oil change, oil filter change, car washing, wheel balancing, tire change and filter check

- Cheaper cost of servicing, quality of services and, coupled with less time consumption were the main reasons behind using outside workshops

Petromin was reportedly the preferred brand across respondents. However, if the car was covered under warranty the relevant supplier was used, a marginal 13% of the respondents didn’t use branded outlets. The most important key drivers were availability of an array of workshops, overall service, product range, competitive prices, discounts, and after sales support.

Almost 75% of the respondents travel nearly 2 hours or more per day

- Respondents in Riyadh travel more than 2 hours (>95%) as compared to travel in Jeddah for up to 2 hrs (75%)

- Cash is the preferred mode of payment instead of any other medium

About App based services, 50% of the respondents believe that Mobile App doesn’t work or assistance from new service providers will be limited in nature.

- Almost 55% of the respondents felt that acceptability at service stations will be poor and limited in remote areas

- 10% believe that it might be expensive to avail that service

KSA is the largest among the new automotive sales and auto parts market in the Middle East, and in 2019, accounted for an estimated 40% of all vehicles sold in the region. The highly anticipated growth in the KSA automotive new sales market is likely to create immense potential for OEMs (Original equipment manufacturers) to create substantial availability of their genuine spare parts in the market.